How It Works

First, A little Context…

When we save money, we do it with the intent to exchange that money for something else that we value later. In essence, we accept certain assumptions about how much our money will be worth in the future, after it has been exposed to economic forces that drive prices upward. Collypto was formed to neutralize those forces on your behalf.

Collypto is the world’s first functional flatcoin. A flatcoin is a cryptocurrency, analogous to a stablecoin, except that its value is “pegged” to purchasing power rather than a secondary currency, security, or commodity. Collypto stabilizes users’ purchasing power, regardless of fluctuations in the market or the value of other currencies. Unlike stablecoins, that use arbitrary minting and burning activities or fiat currencies to maintain a price peg, the value of Collypto credits is guaranteed by the off-blockchain assets that we hold as collateral. With 100% collateralization, unparalleled consumer protections, and unmatched transparency in the industry, Collypto sets the standard for security and stability in digital assets.

What is a Collypto Credit?

A Collypto Credit is a single fungible token on the Ethereum blockchain and is the standard denomination of our cryptocurrency. Every credit is collateralized (backed) by items with intrinsic value that are consumed on a regular basis, such as food, materials, and energy. These items are securely held in the Collypto asset pool. The unique mix of these assets comprise the Collypto Index, which is what we use to determine how much of each item to hold as collateral.

Collypto was formed to fight back against those forces on your behalf. Each Collypto Credit is collateralized –or backed by—items that are consumed on a regular basis, such as food, materials, and energy. The unique mix of these assets make up the Collypto Index, which is what we use to determine how much of each item to buy. As such, each credit represents a slice of purchasing power across the economy. Collypto credits adapt to the cost changes in underlying pricing, adding stability to the value of your credits, and giving you the confidence that your purchasing power is preserved in the long run.

*Allocation percentages are dynamic and adjust based on market forces. Percentages shown are estimates and should be used for illustration purposes only.

Each credit represents an equal portion of value, proportional to the assets held as collateral. Consequently, each credit symbolizes a slice of purchasing power across the economy. Credits automatically adapt to the price changes in the underlying items in the index, adding stability to the value of your credits and guaranteeing that your purchasing power is preserved in the long run.

The value of each credit is identical, and their collateral composition is directly proportional to the underlying holdings of the asset pool. Consequently, each credit symbolizes a slice of purchasing power across the economy. The price of credits automatically adjusts to track the price of collateral assets, stabilizing their value, and guaranteeing that your purchasing power is preserved.

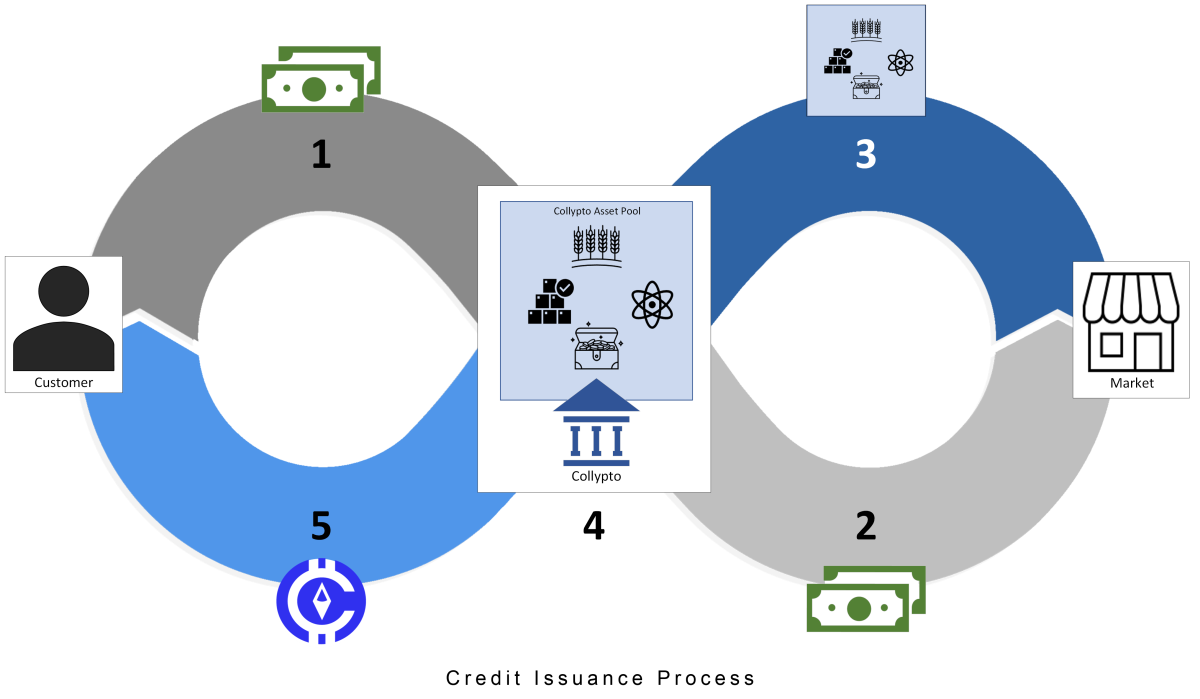

Issuing Credits

Issuance is the process by which we collateralize credits and place them into circulation. Newly minted, uncollateralized credits (blanks) are stored in the Collypto Vault. Before credits are issued, we purchase a corresponding amount of new assets and place them in the asset pool, utilizing the Collypto Algorithm to determine exactly what and how much to buy. This process is entirely automated in our brokerage trading application. Once minted credits have been collateralized, they are issued and enter the circulating supply. Credits are only issued into circulation after we secure the assets that guarantee their value.

1. Customer submits their cash to buy credits.

2. Collypto uses the cash to purchase assets that will collateralize the credits.

3. Purchased assets are added to the Collypto asset pool.

4. Blanks are minted in the vault as needed.

5. Credits are issued to the customer.

Redeeming CREDITS

Redemption is the process by which we remove credits from circulation in exchange for their fair market value in fiat currency. When credits are redeemed, we sell a corresponding amount of collateral assets in the asset pool, utilizing the Collypto Algorithm to determine exactly what and how much to sell. This process is entirely automated in our brokerage trading application. A cash payment is then made to the seller, based on the current market value of their credits. Redeemed credits may be burned or stored as blanks in the Collypto Vault.

1. Customer submits their credits to be redeemed for cash.

2. Corresponding collateral assets are identified in the asset pool.

3. The identified assets are sold at current market price.

4. Blanks are burned in the vault as needed.

5. Cash is paid to the customer.

Economic Resiliency

Regardless of a user’s native currency or geographic location, Collypto will serve their needs as a practical and effective store of value. It is not subject to the inflationary and deflationary pressures of monetary policy makers or the supply manipulation of traditional fiat currencies. When inflation is on the rise, the price of credits will increase proportionally. Likewise, during periods of deflation, their price will decrease proportionally.

Scenario: In January, Jessica has five credits worth $50 each. With two credits, she can buy a basket of groceries that will last her a week. Due to nationwide supply shortages, by October, that basket of groceries now costs $200. As a result of increasing prices, Jessica’s credits are now worth $100 each. Therefore, Jessica can still redeem two credits to buy the same basket of groceries that she could in January. While the price of the groceries has risen from $100 to $200, Jessica’s credits have preserved their value, and she is able to complete her purchase, despite the price increase.

Scenario: In January, Jessica has five credits worth $50 each. With one credit, she can buy a basket of groceries that will last her a week. Due to nationwide supply chain shortages, by October that basket of groceries now costs $100. As a result of increasing prices, Jessica’s credits are also worth $100. Jessica can redeem her credit and buy the basket of groceries. While the price of the groceries has risen from $50 to $100, Jessica’s credits have preserved their value and she is able to buy the groceries, despite the price increase.

The market price of a credit will fluctuate over time, but its value will remain constant. Collypto effectively tracks purchasing power to counter the impact of inflation in fiat currencies. Collypto users should note that an increase in the market price of their credits is generally the result of the diminished purchasing power (inflation) of their native currencies. The associated price adjustment of credits serves to maintain the purchasing power of their users, preserving their value, regardless of the state of the overall economy.

Medallions

Collypto maintains an on-chain status for each Ethereum account, representing the known status of its owner in our off-chain internal systems. By default, this status is “Unknown”. Users have the option of obtaining a “Verified” status on their account by successfully completing the Collypto KYC process. A Verified account is represented in our system by a Collypto Medallion, which serves as a user’s pseudonymous on-chain proof of identity. This is akin to the way that the blockchain allows a user to prove that they own a private key without sharing it with other users. The medallion communicates an added level of credibility, and having a medallion account is what enables a user to receive Verified Transfers. While users may register multiple accounts with us, only one account may be designated as their medallion. Medallions are available exclusively through Collypto Technologies.

Verified Transactions

Verified transactions can only be conducted on a verified recipient account that has been issued a medallion, effectively eliminating the possibility of transfers and allowances being sent to unintended parties. When a verified transaction is initiated, the system checks the status of the recipient account. If it is “Verified”, the transaction will be processed, otherwise, it will fail and the sender will receive an error message. In addition to recipient verification, verified transactions give users the added confidence in knowing that they have the benefit of full recourse for accidents or fraud. For the first time, users have a seamless mechanism for confirming the verification status of recipients before transfers are sent. Collypto also provides standard ERC-20 transfer functions for all users, but sending a Verified Transfer provides an added layer of security and protection. We have provided the sample flow of successful and failed Verified Transfers below.

1. Bob initiates a Verified Transfer to Amy.

2. The Collypto contract checks the status of Amy’s account.

3. Since Amy’s account is verified, the Verified Transfer is successful.

1. Bob initiates a Verified Transfer to Amy.

2. The Collypto contract checks the status of Amy’s account.

3. Since Amy’s address is not verified, the Verified Transfer fails.

4. Bob receives an error message.

Virtual Cold Storage (VCS)

Cold storage devices protect tokens by insulating them from the typical entry points of attackers. Since transactions are signed within the device, the user’s private key is never exposed. This makes it impossible for the device and its associated funds to be compromised remotely. Virtual Cold Storage (VCS) gives users all the benefits of traditional cold storage with the additional barrier of Collypto’s security infrastructure.

VCS has a two-tiered structure, allowing users to choose the level of added security they deem best for their account. They have the option of using a Limited Freeze to freeze a specified number of credits or a Complete Lock to prevent all transfers of credits to or from their account. VCS users maintain custody of their credits at all times and will never have to share or surrender their private keys. Regardless of the option chosen, users will only be able to unlock their account or unfreeze their credits once their identity is confirmed by Collypto Technologies.

Limited Freeze

- Freezes only a specified number of credits in an account to prevent transfer by a malicious actor

- Credits do not leave a user’s account but are “marked” so they cannot be used in transactions

- Leaves any unfrozen credits available for use

- Account remains unlocked and may be used to conduct operations

- Frozen funds are impervious to theft or hardware loss

- Malicious actors can’t transfer frozen credits, even if they have a user’s private key

- No requirement to surrender custody of credits

Complete Lock

- Locks the account, preventing it from sending or receiving credits until it is unlocked

- Locked accounts may only be used to conduct view and allowance operations

- Locked accounts are impervious to theft or hardware loss

- Malicious actors can’t transfer credits to or from locked accounts, even if they have a user’s private key

- No requirement to surrender custody of credits

Account Validation

Some of the biggest losses in the crypto space have come from people sending crypto to the wrong address and losing their money forever. We have created the Collypto Validator, which allows users to add their addresses to the Validated Address List of the CollyptoValidator contract to maximize the integrity of peer-to-peer transactions. Before sending credits, a user will be able to confirm that they have a validated address and that their recipient is in possession of the specified address.

Any Ethereum user can submit a validation transaction to the Collypto Validator with an optional validation code. The validation code can be any word, phrase, or combination of symbols used to uniquely identify the user’s transaction in the Ethereum event logs. Since each transaction is signed with the owner’s private key, when the transaction appears on the blockchain, it will map back to their public address. That public address is then added to the Validated Address List.

Though this functionality appears similar to verification status and verified transactions, validating addresses does not require transacting parties to complete the Collypto KYC process and provides no recourse in cases of theft, fraud, or account compromise. The purpose of this feature is to serve as a transactional safeguard in regions where we do not issue medallions and user verification is not available. Validation may be repeated any number of times using custom validation codes for a given Ethereum account.

Collypto does not provide built-in functionality for validated transfers of credits. The Collypto Validator has been deployed and is available on the Ethereum blockchain, but wallet developers will need to incorporate it into their respective applications to make its functionality available to users. For purposes of wallet development, the Validated Address List would need to be checked prior to allowing users to submit validated transfers. The account validation process is illustrated below.

1. Amy submits a validation transaction to the Collypto Validator with the validation code “It’s Amy”.

2. Amy’s public address is added to the Validated Address List, and the resulting event can be found in public Ethereum event logs with the validation code “It’s Amy”.

3. Bob checks the Ethereum event logs to confirm Amy’s address and validation code.